Indian equity markets ended a two-week losing streak and advanced over 1%. The NIFTY50 index reclaimed the crucial 25,000 mark, while SENSEX ended the week above 82,000 level. The sharp rebound was fuelled by a double boost from the Reserve Bank of India (RBI).

The central bank announced a larger-than-expected 50-basis-point interest rate cut and a 100-basis-point reduction in the Cash Reserve Ratio. This injected fresh optimism into the markets. Rate-sensitive sectors such as Banking (1.4%), Financial Services (+1.3%) and Realty (+9.5%) led the rally. Additionally, the RBI’s downward revision of inflation forecasts further boosted investor sentiment.

Broader markets continued their outperformance against the benchmark indices, with both NIFTY Midcap 150 index and the Smallcap 250 index climbing over 2.6% for the week.

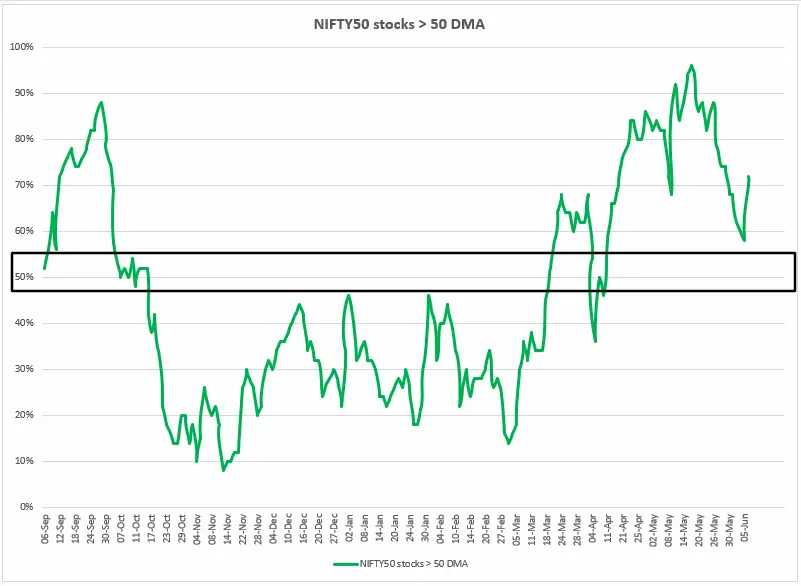

Index breadth

The breadth of the NIFTY50 index slipped to 58%, with fewer stocks trading above their 50-day moving averages. However, sentiment improved sharply on Friday, with the breadth of the index rebounding to 72%, supported by positive domestic cues. Despite this late surge, the NIFTY remained in a consolidation phase for the third consecutive week, achieving a modest overall gain of 1%.

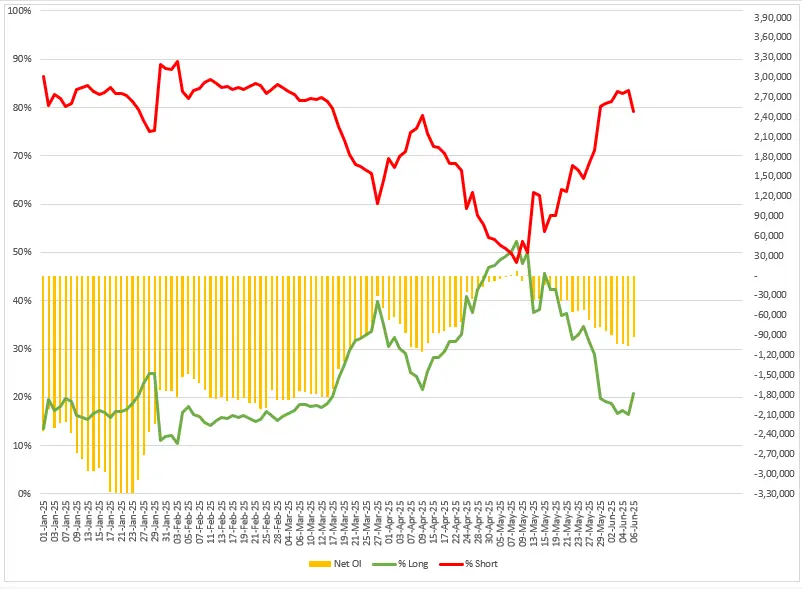

FIIs positioning in the index

Foreign Institutional Investors (FIIs) sustained their bearish bets on the index futures throughout the week, though they covered some of these bearish bets on Friday. The week began with a long-to-short ratio of 19:81, which FIIs slightly improved to 21:79. However, their overall stance remains bearish, with net open interest in index futures standing at -92,000 contracts.

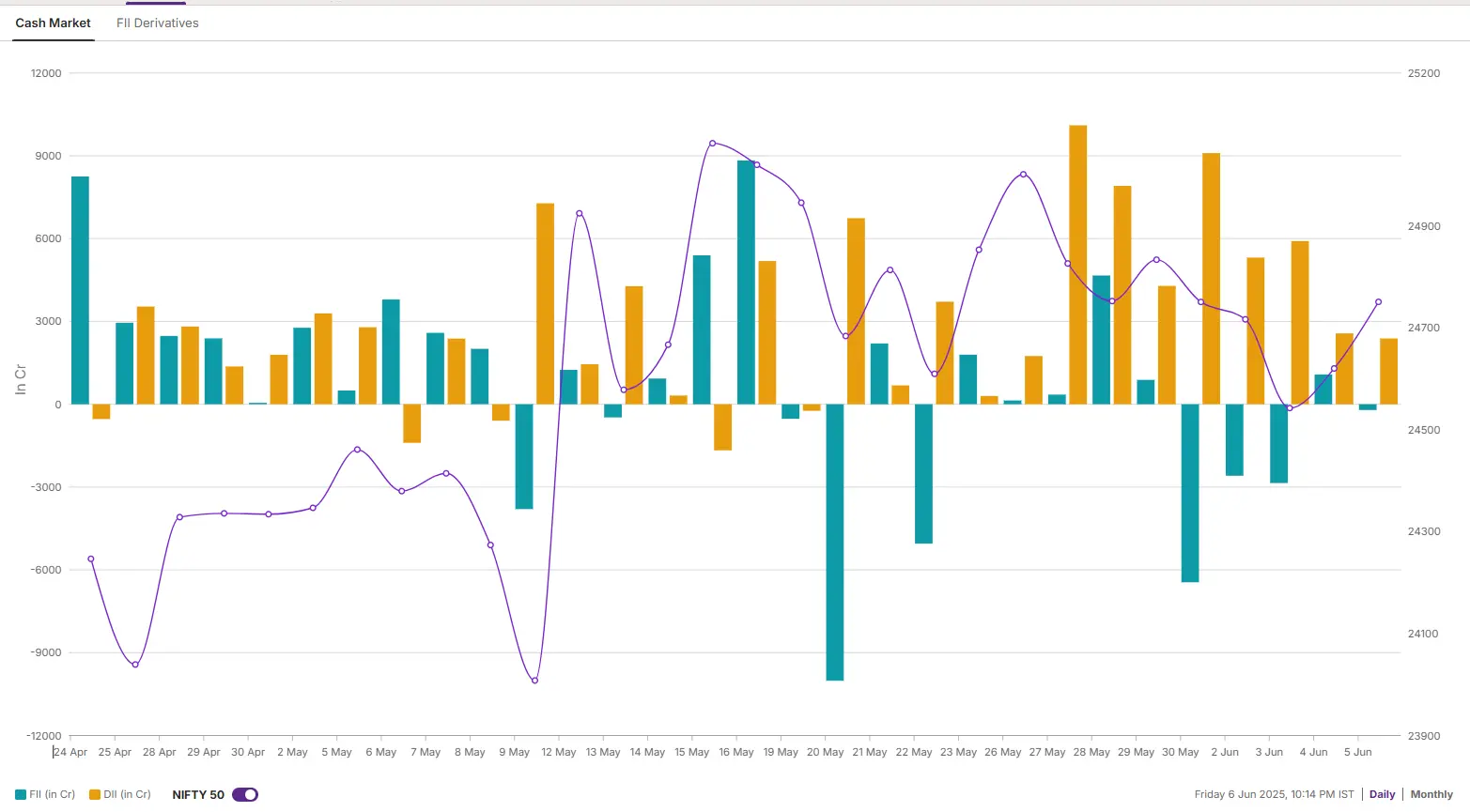

The bearish positioning of the FIIs in the index futures was in line with their cash market activity as they sold shares worth ₹3,565 crore. Meanwhile, the Domestic Institutional Investors remained net buyers and purchased shares worth ₹25,503 crore.

NIFTY 50 index

The NIFTY50 index sustained its bullish momentum above the immediate support zone of 24,500 and 23,800. The index formed a bullish candle on the daily chart resembling the bullish hammer although not the classical one. However, the index is still consolidating in the 25,100 and 24,500 range for the last three weeks. A close above or below these levels on the daily chart will provide further directional clues.

BANK NIFTY

The BANK NIFTY index ended the week at a fresh record high and reclaimed the psychologically crucial 56,000 mark on the closing basis. The index moved out of its three week consolidation and has formed a bullish candle on the weekly chart.

The technical structure of BANK NIFTY remains bullish with immediate support around 55,400 zone. Unless the index slips below this zone on a closing basis, it may sustain the bullish momentum.

🗓️Key events in focus: In terms of global events, focus will shift on the retail inflation data in the U.S. This data will be released one week before the outcome of the U.S. Federal Reserve meeting. Given the resilience of the labour market and the core CPI exceeding the FOMC’s 2% target, it is likely that the central bank will maintain its interest rate policy. On Thursday, the Producer Price Index, which is a measure of wholesale inflation, will be released. On Friday, the University of Michigan will release its Consumer Sentiment Index.

On the domestic front, retail inflation data will be released on 12 June. Experts believe that the reading of inflation may further ease to 3% or below in May. This would mark the fourth consecutive month of sub 4%.

📌Spotlight: The Realty index jumped over 9% and was the top sectoral gainer. The sharp rally comes after the Reserve Bank of India announced a 50-basis-points cut, its third consecutive reduction in 2025 totalling 100 basis points. This decision, coupled with reduced cash reserve ratio pushed real-estate stocks such as DLF (+9%) and Godrej Properties (+9%) higher for the week.

🛢️Oil: Crude prices snapped two-week losing streak advanced over 6%, forming a bullish candle on the weekly chart. The rally was driven by a stronger-than-expected U.S. jobs report, which improved the outlook for oil demand. Additional support came from easing trade talks tensions between the U.S. and China. Meanwhile, Saudi Arabia also indicated that OPEC+ may increase production to meet the expected rise in demand over the summer, which further influenced market sentiment.

📓✏️Takeaway: In our previous three blogs, we highlighted that the technical structure of the NIFTY50 index remains range-bound between 24,500 and 25,200. Markets extended the consolidation for the third week in a row and formed the third inside candle on the weekly chart.

However, the index reclaimed its psychological level of 25,000 on a closing basis. For the upcoming week traders can monitor the price action of the index around the 25,200 zone. A decisive close supported by bullish candle will signal the breakout of the range. Conversely, a rejection from this zone will push the index back into consolidation zone.

Disclaimer:

Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.