- XAU/USD regained $3,360 after paring gains earlier, that push Gold towards $3,320.

- US May CPI undershoots forecasts, lifting hopes for Fed easing in September.

- US-China trade talks show progress, but approval is still pending from top leaders.

Gold prices posted modest gained over 0.97% on Wednesday as the latest inflation report in the United States (US) revealed that prices are cooling. Hence, investors increased their bets that the Federal Reserve (Fed) would resume its easing cycle in September. The XAU/USD trades at $3,363.

May’s Consumer Price Index (CPI) in the US provided an opportunity for Gold buyers. The print dipped compared to April’s data, and Bullion prices spiked toward a daily peak of $3,360 – in the headline – before erasing those gains.

Uncertainty around negotiations between the US and China will most likely keep Gold prices higher. Although US Commerce Secretary Howard Lutnick said that they’ve reached a framework to implement the Geneva Consensus, it is pending approval from US President Donald Trump and his counterpart Xi Jinping.

At the same time, the Chinese Vice Commerce Minister Li Chenggang said that talks “involved in-depth exchanges and communication had been rational and candid.” He added that he will report on the framework to leaders and expects that the progress could increase trust between the two countries.

Traders’ focus shifted to the release of the Producer Price Index (PPI) figures and jobs data. The latest ISM Purchasing Managers Index (PMI) surveys showed that input prices for companies had risen. Although May’s CPI data was positive, analysts suggest that households are yet to feel the impact of tariffs.

Daily digest market movers: Gold holds firm as the Greenback, US yields plunge

- The weakness of the US Dollar might keep Gold prices underpinned. The US Dollar Index (DXY), which tracks the value of the Dollar against a basket of peers, falls 0.44% to 98.61, reaching four-day lows.

- US Treasury yields are collapsing; The US 10-year Treasury yield has dropped five basis points (bps) to 4.42%. US real yields followed suit, falling by five basis points to 2.13%, boosting Bullion‘s advance.

- US inflation rose less than expected in May, with headline CPI up 2.4% YoY, below the 2.5% forecast but slightly above April’s 2.3%. The Core CPI remained steady at 2.8% YoY, matching the previous month’s figure and indicating persistent yet stable underlying price pressure.

- Geopolitical tensions remain high as US President Trump told Fox News that Iran is becoming much more aggressive in nuclear talks. The Iranian Foreign Minister said, “As we resume talks on Sunday, it is clear that an agreement that can ensure the continued peaceful nature of Iran’s nuclear program is within reach — and could be achieved rapidly.”

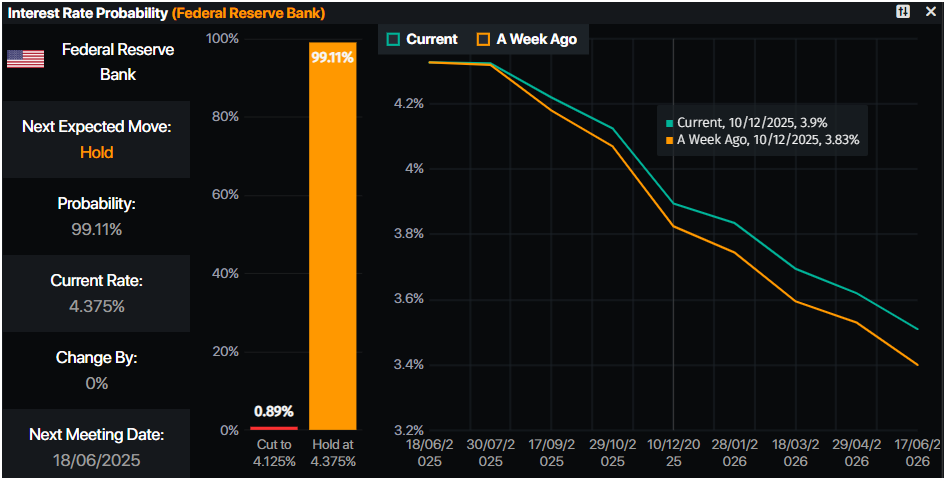

- Money markets suggest that traders are pricing in 47.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price consolidates below $3,400

Gold price remains upwardly biased, but price action over the last two days indicates that buyers are reluctant to drive the spot price above $3,400. The Relative Strength Index (RSI) shifted flat near its neutral line, further confirmation of a trendless market.

For a bullish continuation, XAU/USD needs to climb above $3,350 to challenge $3,400. Further strength lies in $3,450 and the all-time high (ATH) at $3,500.

Conversely, if Gold slumps beneath $3,300, it opens the door to test key support levels, such as the 50-day Simple Moving Average (SMA) at $3,269. Below that level lies the April 3 high-turned-support at $3,167.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.