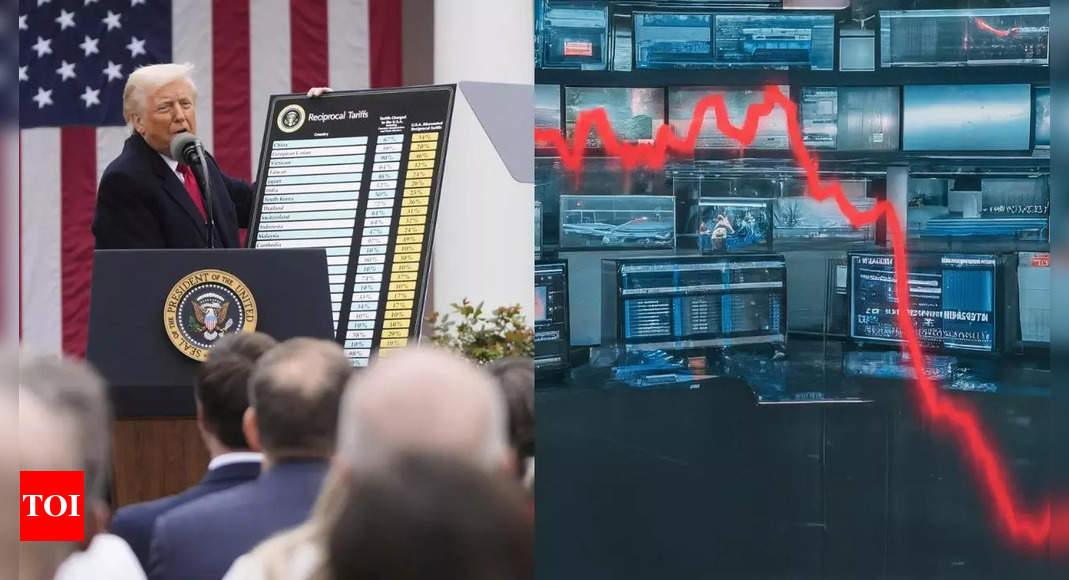

NEW DELHI: A global market rout intensified Monday following US President Donald Trump’s announcement of sweeping tariffs and Beijing’s retaliation with 34% duties on all US imports starting April 10.

Stock markets across Asia plunged sharply, with investor sentiment collapsing as fears of a global trade war took hold. Analysts say over $9 trillion in market value has been wiped out in just two days, drawing comparisons with the 2008 financial crisis.

Wall Street is bracing for further losses after Friday’s sharp downturn. The S&P 500 fell 6%, the Dow Jones dropped 5.5%, and Nasdaq tumbled 5.8%, marking their worst single-day performance since the pandemic began. Meanwhile, US crude prices fell below $60 per barrel and the dollar weakened to 145.98 yen, showing a shift to traditional safe havens.

Meanwhile, Top Trump officials said that over 50 countries have reached out to the White House for tariff talks after sweeping import taxes rattled global markets. Treasury Secretary Scott Bessent warned that resolving unfair trade practices won’t happen quickly.

India: Bloodbath amid global shockwaves

Indian equity benchmark indices — BSE Sensex and Nifty50 — nosedived on Monday, plunging over 3.5% as mounting global trade tensions and external headwinds sent shockwaves through investor sentiment.

Both indices suffered sharp intraday losses of nearly 5% before staging a partial recovery. The Sensex closed 2,227 points or 2.95% lower at 73,137.90, while the Nifty50 settled at 22,161.60, down 743 points or 3.24%.

Tata Steel (-7.78%), L&T (-5.88%), Tata Motors (-5.56%), Kotak Mahindra Bank (-4.42%), and M&M (-4.06%) were among the biggest laggards on the Sensex. All 13 sectoral indices ended in the red, with technology stocks — heavily exposed to the US market — dropping 7%. The broader market saw a steep fall, with small- and mid-cap stocks down 6.2% and 4.6%, respectively.

The latest market rout is being attributed to escalating fears of a global trade war, compounded by fresh US tariff measures and weak global cues.

Amid the volatility, a senior finance ministry official told Reuters that India remains on track to meet its FY26 GDP growth target of 6.3–6.8%, assuming crude oil prices remain below $70 a barrel.

South Korea: Kospi dives 5.5% as tech sector reels

Seoul’s Kospi dropped 5.5%, driven by losses in tech and manufacturing stocks. South Korea, heavily reliant on exports to the US and China, faces a dual-front challenge.

Taiwan’s decision to restrict short selling spurred brief hope for stabilisation, but regional sell-offs continued.

Kevin Hassett, head of the US National Economic Council, claimed, “More than 50 countries have reached out to the president to begin a negotiation.”

Japan: Nikkei 225 plummets 7.1%

The Tokyo market plunged 7.1%, with brief intra-day losses nearing 8%. Investors rushed to safe-haven assets, pushing the yen to 145.98 per dollar.

US crude dipped below $60 per barrel for the first time since April 2021, highlighting global demand concerns.

Donald Trump, unphased by the chaos, said, “Sometimes you have to take medicine to fix something.”

China: Tariff retaliation deepens crisis

Beijing retaliated with a 34% tariff on all US imports starting April 10, sending the Shanghai Composite down 6.5%.

The Chinese Commerce Ministry described the move as a direct counter to US “aggression,” escalating fears of a prolonged trade standoff.

Fed Chair Jerome Powell warned, “The trade war could lead to higher inflation and lower growth.”

United States: Wall Street braces for more bloodbath

Following Friday’s historic crash—S&P 500 (-6%), Dow (-5.5%), Nasdaq (-5.8%)—US futures pointed to more losses.

Trump doubled down: “THIS IS A GREAT TIME TO GET RICH.” Yet Jerome Powell responded firmly, “Our obligation is to keep longer-term inflation expectations well anchored.”

GE Healthcare and DuPont saw double-digit losses amid fears of a regulatory clampdown from Beijing.

Taiwan: Index plunges nearly 10%, short selling curbed

Taipei’s Taiex fell 9.8% as trading resumed after a holiday. Regulators introduced temporary curbs on short selling until Friday to prevent a deeper rout.

President Lai Ching-te said Taiwan would not impose retaliatory tariffs but aimed to negotiate a zero-tariff deal with Washington. A $2.7 billion stimulus was announced to cushion domestic impact.

Australia: ASX hits 15-month low

Australia’s ASX 200 sank 6.3%, marking its lowest point in nearly 15 months. Prime Minister Anthony Albanese said, “You can’t change global events. What you can do is prepare for them.”

The US imposed a 10% tariff on Australian goods, intensifying fears of recession.

Singapore: Markets tank 8.5% on opening

Singapore’s Straits Times Index crashed 8.5%, reflecting one of the steepest regional drops.

The city-state’s heavy reliance on global trade has made it especially vulnerable to the spiralling tariff war.

South Korea’s benchmark KOSPI index dived 5.26 percent, or 129.57 points, to 2,335.85, triggering a so-called sidecar mechanism that briefly halted some trading for the first time in eight months.

“South Korea has a very high trade dependency; it’s a country that lives off trade, so when the US imposes excessively high tariffs like this, we become one of the hardest-hit economies,” Kim Dae-jong at Sejong University in Seoul told AFP.

United Kingdom: FTSE braced for sharp losses

UK markets were closed at the time of writing but are expected to open sharply lower. Prime Minister Keir Starmer, in an op-ed, wrote, “The world as we knew it has gone,” urging a new focus on “deals and alliances.”

Saudi Arabia and Gulf: Historic slump as oil giants hit

Saudi markets plunged 6.78% on Sunday—its worst day since the pandemic. Aramco shares lost 6.2%, slashing over $133 billion in market value. Gulf peers Kuwait (-5.7%), Qatar (-4.2%), and Oman (-2.6%) also posted losses.

“Trump’s tariffs weighed heavily on global markets, and specifically today on Saudi markets,” reported state-run Al-Ekhbariya.

What lies ahead: Interest rate dilemma, inflation concerns

With global economic uncertainty mounting, central banks face pressure to act. But Powell signalled a cautious stance: “A one-time increase in the price level must not become an ongoing inflation problem.”

The Fed now faces a trade-off—cut rates to cushion economic pain, or stay firm to prevent runaway inflation.

As panic ripples across global markets, investor sentiment hinges on whether diplomacy can replace confrontation. As Trump put it, “They’re dying to make a deal.”